Establishing a payroll management system from scratch is an arduous task for any payroll professional.

The main reason behind this is the unlikeliness to see the process’s barriers before embarking on the project.

Identifying the potential barriers at the initial stages will save your time, effort, and money, thus creating an exact route to success. When you identify the barriers, only then will you be able to rectify them.

It is crucial to find such bottlenecks in the early stages. It will help you make a better plan than simply purchasing a payroll management system that will eventually become a liability if it is not effective enough.

This article has highlighted the barriers while implementing a payroll management system along with their solutions. Click here to find the best payroll management systems available.

1. Underused payroll data

Payroll reporting data is often underused yet holds a substantial value in setting up an effective payroll management system.

Some of the payroll data comprise tax benefits, compliance audits, overtime analysis, and wage recovery. When you don’t utilize these data, then problems start to pile up.

For example, Suppose your payroll specialist wants to know where overtime expenses are occurring, then they can instantly look into these payroll insights to sort out the issue.

Many companies aren’t addressing this issue to shape up their business.

To overcome this trouble, you can educate all the team members regarding the advantages of using payroll data.

2. Importance of Mergers and Acquisition

Often, companies make the mistake of not including mergers and acquisition in payroll. Ultimately, it results in inefficiency across the businesses.

For instance, when you plan to merge with a company in Spain, you have to consult their payroll team to understand their operational structure.

Else, you will acquire non-standard business practices that clash with your Standard Operating Procedure (SOP).

Perhaps, it might lead to merger collapse or short notice to rectify the mistakes.

To solve this, you should ensure the firm stand of both payroll organization in the merger and acquisition process.

3. The Global Shared Services (GSS)

When you are expanding your business across horizons, then you should be cautious about this popular misconception.

A Global Shared Services (GSS) structure may seem to work for all aspects of your business but not for a global payroll management system.

For example, the payroll legislation and regulations are entirely different for the United Kingdom and the United States. From data security requirements to fines & penalties, everything varies.

It is incredibly tedious to hold on to the payroll processing in a GSS model as there is no unified global payroll approach.

Ultimately, it costs you immensely. To tackle this issue, you can choose to seek the help of local payroll providers.

As they are well aware of their country’s cultural and technical nuances, you can save your business from making severe blunders.

4. Difficulty in recruiting payroll professionals

Since people handling payroll in any business are from HR, accounting, finance, or other related backgrounds, it would be challenging to recruit specifically.

No one would have done payroll as a degree in college- its degree doesn’t exist.

To fill in the knowledge gap, educate and train them according to your company’s payroll requirements, compliance, and financial systems.

5. Issue in Compliance

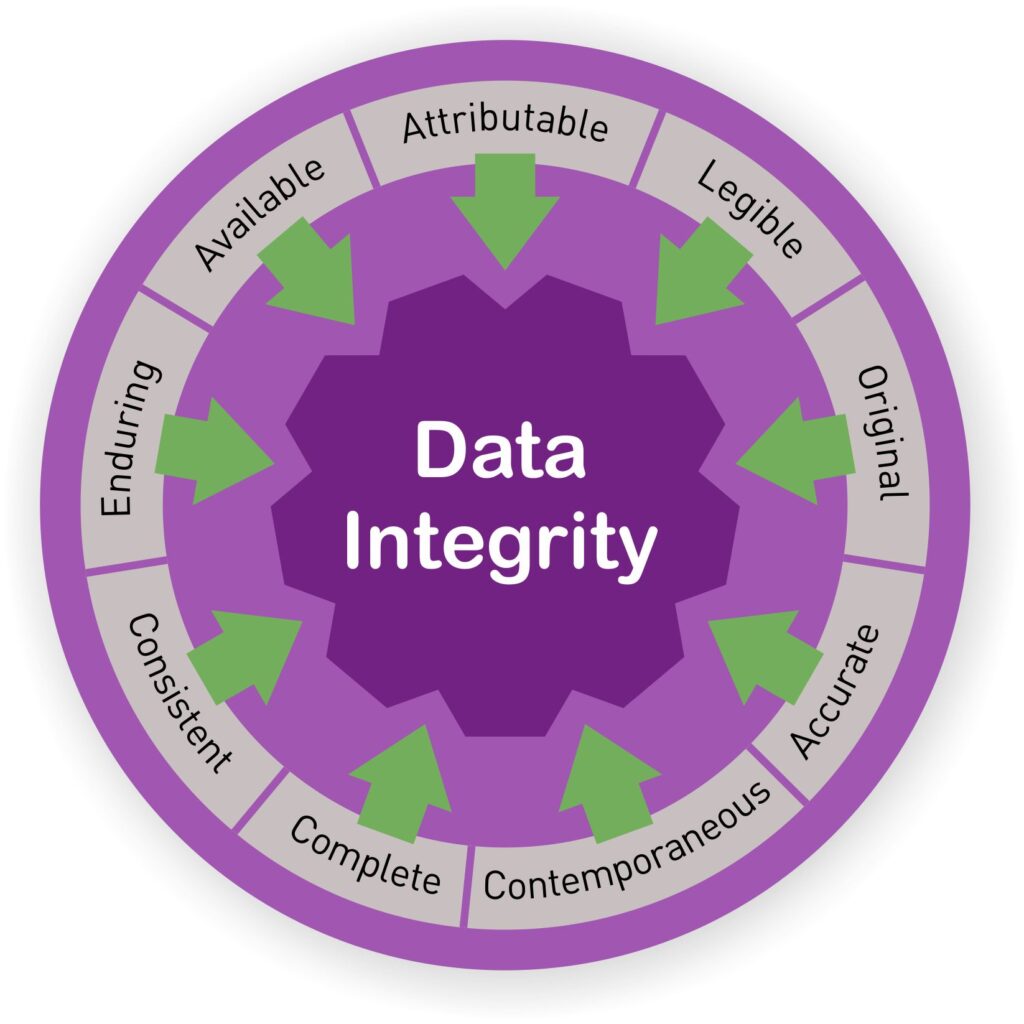

For maintaining data integrity, it is good enough to handle payroll as a constant inputting process.

Briefly, when your employees regularly feed the multiple data sets in the automated payroll management system, compliance issues are expected to arise.

This is why it is good enough to exhibit compliance at the forefront of enhancing your operational model.

It will also be helpful during the reconciliation process.

For instance, imagine you’re hiring ten new employees. Is it possible to show them how you reconcile and track payroll systems and HR? You can’t do it unless your reconciliation is in place.

Instead of carrying forward with this issue, you can include detective audits as a part of your operational model.

Features of Payroll Management System that you should look for to avoid barriers

It can often get a little tricky to keep these barriers at bay at all times. However, when you find yourselves a payroll management system keeping in mind the features that you need, reducing such barriers could be your solution.

- Direct Deposit: This feature allows you to avoid printing and handing out paychecks to employees in different departments. Instead, with the tool, salaries directly get deposited in the bank accounts of employees, simplifying the salary process for everyone involved.

- Tax Filing: You simply cannot miss out on filing your taxes and that too accurately. When you invest in a payroll management system, you get to use the tax filing features. No more missing out on dates. No more potential mistakes and miscalculations.

- Employee Self Service: Quite often it happens that a majority of the time of either the HR or the employee or both is spent on searching for one particular document. With this tool, this can easily be done. You can give access to employees and they can check or update any piece of information themselves.

- Compliance Management: This digital software allows you to ensure that your regulations are relevant and lawful. It is important to do this in order to avoid any sort of legal actions or potential fees from lack of compliance management.

- Compensation Administration: Managing compensation is not similar to managing wages or salaries. Bonuses and compensations are often handled according to the joining terms, performance, etc. You can use a compensation management feature to make this process easy for you.

- Reporting: There is no point in digitally tracking your payrolls if you don’t know how it performed. This tool gives you an insight into the taxes, budget, compensation, and other data. You can use these reports to observe patterns, find areas of improvement, and work on them.

The Bottom line

When you carefully plan and execute, the payroll management software like UZIO would be seamless and conservative. So, check into these barriers and implement the ways we have suggested for the best results.

![Calgary’s Hottest Neighborhoods for Luxury Homebuyers [2024]](https://thewashingtonote.com/wp-content/uploads/2024/04/Calgary-324x160.png)