Paying representatives is a fundamental piece of carrying on with work. By all accounts, this seems like the most un-muddled work process your organization needs to make due. Truly, there are various normal finance botches that organizations make — and a large number of these can be very exorbitant. Besides the fact that you risk a review, however, you can harm your relationship with workers and cause a significant migraine in pinpointing and fixing the issue that caused the mistake in any case.

Finance missteps can make a dark imprint on a generally excellent organization profile. Inability to agree with the government, state, or nearby standards can prompt devastating charges or occupation candidates looking past your business to one more responsible. This article covers 9 normal finance botches, also do check paystubs if you want to dig deeper. You will most definitely find the thing you’re searching for.

1. Not comparing current data to data from the previous year

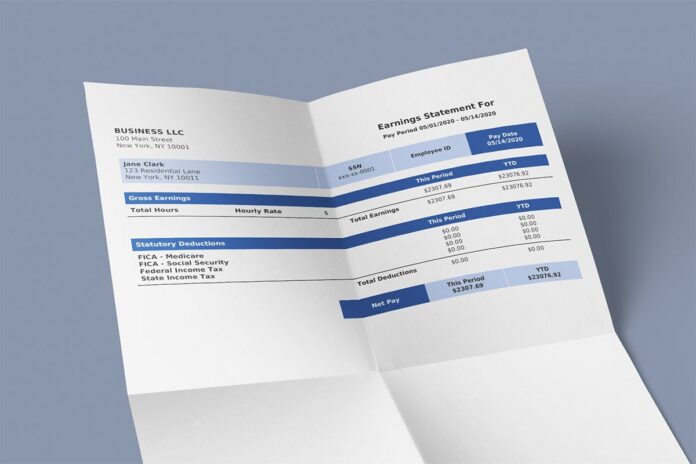

A worker must know the correlation between current information and year-to-date information. It will be difficult for the staff to know the sum on the off chance that you don’t mark each dollar. The whole data can be utilized to decide different variables like expense and advantage savings, compensations, and considerably more. It is an unquestionable necessity to continue to follow everything to make a business effective.

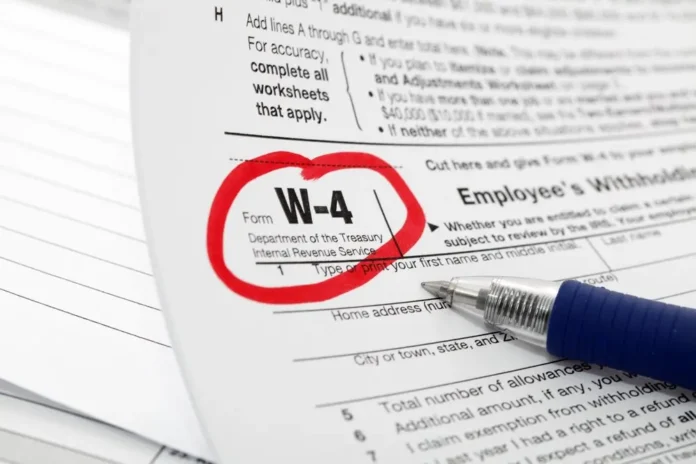

2. Obsolete W-4 Data

In a worker’s life, numerous things continue to change with time. It is an unquestionable necessity to change the information in regards to compensation climb, refreshing mate or kid data, and so forth, in the structure. If you have any desire to handle the finance, the structure should have the current and right information. You should request that the framework update the data at whatever point required and utilize that structure for continuing with the finance.

3. Mistaken Cycle of Payroll

The laborers in an organization need to zero in on the compensation cycle to deal with their funds. The genuine pay stubs should consider the installment date, and laborers should realize the handling pay strategy as often as possible. The organization should utilize the right compensation cycle for dealing with their worker’s wages.

4. Tax Information That Is Inaccurate

The laws of bureaucratic and state legislatures connected with charges continue to change with time. The compensation stub contains data in regards to the ongoing laws of assessments. On the off chance that you have referenced wrong saved portions, the laborer will have a surprising risk on charges at the end of the year-end. There are potential outcomes of punishments and expense underpayment. It is important to oversee things appropriately because a specialist should pay the duties with practically no real excuse.

5. Not ascertaining everything accurately

The main mix-up that numerous businesses make isn’t working out every piece of the check accurately. The genuine pay stub can help you out with this cycle a great deal, particularly if you use the check stub producer. This implies that you should give the fundamental check number, and afterward add data about any rewards, extra time, charges, and whatever else that might influence the last aggregate. Know that when you compose things bit by bit, you can undoubtedly work out everything, you can show your representatives confirmation of why they procured however much they acquired, and you will ensure there are no slip-ups or mistakes in the last report.

6. Not focusing on the date

The date is another essential part that you can’t pass up. Many individuals commit this normal error while making the genuine paystub, and they don’t focus on the distinction between the ongoing time frame, and the year-to-date information. On a similar note, you ought to always remember to add the legitimate date, and if necessary, you can talk with an expert on the best way to do this accurately.

7. Passing up significant parts

Presently we should discuss another mix-up you yell and attempt to stay away from. While making the genuine pay stub, you should add the absolute hours that have been worked by your worker, and this implies that you ought to add the typical hours as well as the ones that were finished after some time. You ought to likewise not neglect to add the comprehensive dates, the gross and net wages, and if conceivable, you ought to add every one of the different hourly rates in the genuine paystub. This is simply an aspect of the data that you shouldn’t pass up, and contingent upon your profession, you might have to add more or fewer subtleties.

8. Not adding the subtleties of the business

While making this archive, you want to add the subtleties of your business. Know that when you make the check hits, you want to add more data about your worker, yet additionally about the organization that endorses the installments. This implies that while making the genuine pay stub, you ought to add the name and the location of the lawful element – the business, and if necessary, you ought to give more subtleties. By and large, the legitimate name and the location will do the trick, yet you ought to twofold check with the ongoing regulations and guidelines in your area.

9. Adding an excessive number of subtleties

The last slip-up that a business could make is adding an excessive number of subtleties in the genuine paystub, and making disarray or sharing individual data that ought not to be shared. Know that even though you should add the government-managed retirement number of your representatives in the archive, you ought to never completely compose it. The law expects you to add simply the last four digits of it, and you ought to likewise incorporate the name of your colleague.

Wrapping Up

These are probably the most well-known botches that you ought to attempt to keep away from while making your genuine paystub. Realize that there is only the layout you want to follow, and when you make it, you can involve it in any future arrangements. You ought to depend on the web-based generators to help you out with the cycle, and if you assume you are passing up something, you can continuously converse with a monetary consultant. Thank you!

![Calgary’s Hottest Neighborhoods for Luxury Homebuyers [2024]](https://thewashingtonote.com/wp-content/uploads/2024/04/Calgary-324x160.png)