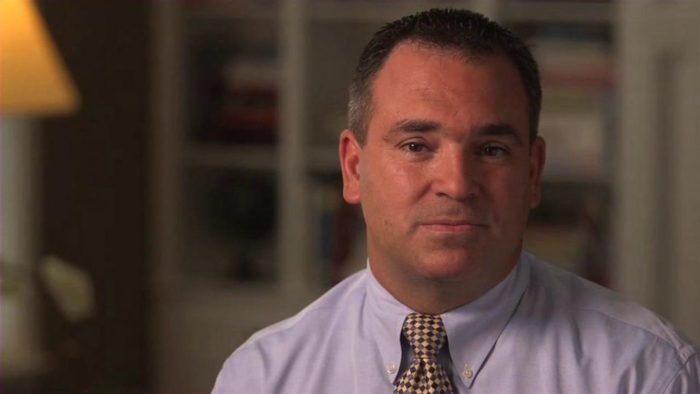

In this article, A Better Financial Plan founder and CEO, Dean Vagnozzi talks about the common myths of retirement planning and the lessons we learned along the way.

Just a heads up, before you start reading, you should know that I am about to completely trash conventional financial planning instruments such as the 401(k) and IRA. In this article, I will be honest about why the 401(k) and IRA are the most inefficient financial vehicle in today’s economy. It normally requires a lot for me to get excited, but I am super pumped to be writing this article and being honest, open, and transparent about why 401(k) and IRA are severely flawed and what should people do instead.

Who Should Read This Article?

If you are still working and saving money for retirement, reading this is a must. Imagine a 10-mile traffic jam on the highway. My job is to show you the detour to avoid the financial logjam up ahead. If you are retired and not contributing to a 401(k) or IRA anymore, I still want you to read on because you will likely say to yourself, “Yeah, he is spot-on. Why couldn’t I have learned this 30 years ago?” You, too, Mr. or Mrs. Retired Person, will benefit from the following paragraphs.

What’s the Perfect Retirement Like?

I want you to take a moment and think about what your perfect retirement looks like. Think for a minute or two of what you’d like your financial status to be in that period of your life. If you are like most people, the vision of your retirement, financially speaking, has you living in a home that you have paid off years before and a home that holds plenty of memories of raising your now-grown children.

You are getting money from your 401(k), getting a little bit of Social Security, and living the lifestyle that you’d hoped for (traveling when you want, visiting the grandchildren often, and exploring things that you’d hoped you’d explore once you got here). But what if I told you that the road you are currently on, the road that you decided to take to get to your retirement, was backed up for miles and miles because of some unforeseen problem ahead? If that were true, would you want to know immediately—I mean, would you want to know that this was the case right now, today, without delay? Of course, you would.

Now, I have bad news for you, I’m afraid. The single most popular retirement plan in the United States is sort of like that backed-up route to your vacation destination. There’s a problem ahead and you need to adjust course now in order to account for the problem. You need to examine an alternative route and take it so that the flaws of the status quo retirement savings plan don’t keep you from reaching that perfect retirement we mentioned just a couple of paragraphs ago.

But First, How Did 401(k) Come into Existence?

Before we dive into why 401(k) is not the best route out there, it’s important to understand how 401(k) came into existence. First, the 401(k) was never supposed to really be the primary source of savings/financing. Since the early ’80s, an entire industry has evolved to exploit a section of the IRS code that was originally intended for something completely different.

Section 401(k) of the Internal Revenue Code was added as a compromise between the federal government’s desire to tax high-income earners AND high-income earners’ desire to decrease their income tax rate as much as possible. The original language of the code allowed employers to decrease profits in a manner that would decrease, or, rather, defer, their tax burden. In 1980, Ted Benna, an employee benefits consultant, noticed that the code could potentially allow employees to take a similar advantage. On behalf of his employer, Mr. Benna petitioned the IRS to modify 401, section k, to allow such funds to be created. Therefore, in 1981 the code was amended, and as early as 1983, there were seven million 401(k) participants. As of 2014 (according to the Investment Company Institute, Federal Reserve Board, and Department of Labor), there are over $4.4 trillion (yes, with a t) tied up in 401(k) plans.

Why Won’t 401(k) and IRA Work Anymore?

Before we look at what’s wrong with 401(k) and IRA, let’s look at why they won’t work in today’s time and age.

- The decline in Pension Funds

Here we are 40 years after the dawn of the 401(k). The landscape has been radically changed for the average American. In the late ’70s and early ’80s, nearly 80% of all labor had a pension plan as part of their entire compensation package. In addition, the 401(k) was ADDING on to what had been the established long-term financial plan for nearly everyone across the entire country since World War II. Read that sentence again because it is important. The 401(k) was an addition to the prevailing wisdom of long-term savings at the time. Thus, while the 401(k) helps save you on your taxes, it was never intended to be the primary source of finance later on in life.

- Social Security Insolvency

Fast-forward now to the third decade of the new millennium and it is a different environment. Many of our political leaders believe that Social Security will be insolvent in the 2030s if nothing is done to address the strains on the system’s current infrastructure. Today, fewer than 10% of employees have any sort of pension plan on which to depend. The 401(k) was the third leg to a retirement savings strategy stool; now, for most people, it is the only leg.

- Taxes Poised For an Increase?

Most employers have dropped pension plans and there is a serious risk that Social Security will be insolvent after 10 years. Today, there are a few other “issues” in our country that are extremely expensive to maintain or fix. Skyrocketing healthcare costs, our global military footprint and our national debt are just a few that come to mind. There are dozens of other examples that can be given. It doesn’t take an advanced degree in economics to know that the government is going to need more revenue to fix many of these problems or to fund the programs currently in place. The logical solution to the need for more revenue is an increase in taxes. After all, whether you realize it or not, since the IRS was formed in 1913, income taxes in our country are as low as they have ever been.

What is the point of all of this? Well, you most likely chuckled to yourself when I asked whether taxes were going higher and probably nodded your head. Yet the 401(k) and IRA are financial vehicles that defer your taxes until a later time when you just agreed they would be higher. See where I’m headed with this?

Taxes in our qualified plans aren’t avoided; they are deferred. I can tell you from experience that hardly anyone ever mentally factors in what the bite out of his or her retirement income is going to look like when he or she becomes responsible for paying those taxes. Don’t take my word for it, I would encourage you to seek out the 70-somethings in your life and ask them how they feel about the income tax that leaves their hands every time they draw on their qualified account. They’re not going to be smiling when they tell you the answer. I promise you that, if they are honest, they are going to come clean with you that they really hadn’t anticipated how much that tax bill would sting. There is a cost to deferring your taxes; unfortunately, no one ever examines it in order for us to make a better decision over whether that cost is worth accepting.

Your Average 401(k) and IRA – A Real Life Example

Let’s assume that a young woman in the 33% tax bracket began saving when she was 35 years old. She puts $4,000 away diligently into an IRA. So, her total annual tax deferment will be about $1,320. Now to make it easy, we’ll do two things. First, we’ll give her an annual return on her investment of 10%. Yeah, I know we just spent time calling out the fact that the market will probably never give you year-over-year actual growth of 10%, but let’s just assume that this is what she’ll be earning. The second assumption we’ll make is that she’ll maintain the $4,000-a-year contribution for each of the next 30 years. So it looks like this.

Annual savings: $4,000

Duration: 30 years

Tax bracket: 33%

Annual taxes deferred: $1,320

Total saved at 10%: $723,744

Total taxes deferred: $39,600

Now let’s focus on the distribution of her IRA. Will she likely take a lump-sum distribution from her IRA? No, that can’t happen. Because, where would she put it? Instead, she will likely withdraw the money over time. Let’s assume a 10% withdrawal each year, as she continues to earn 10% on the balance. Believe it or not, I’m trying to make this look as good as I can for her.

Annual withdrawal: $72,000

Tax bracket 33%

Annual taxes paid: $23,760

Net income: $48,240

The bottom line here is that between the ages of 65 and 85, this woman will have paid over $450,000 in taxes for the right to have saved $39,600. Please explain the tax efficiency of this approach—please.

Unveiling the Truth

Now, one of the first arguments that people make when I run through this example goes something like this: “Yeah, but wait a minute—you’ve kept her in the same tax bracket. My accountant told me I will be in a lower tax bracket.” You see, this right here is why you need a team of advisors, which we’ll get to later. When I get that question (and I always get that question), I look at my audience and I say the following: “If you are in a lower tax bracket when you retire, then it means you have FAILED FINANCIALLY!”

Who the heck wants a financial plan designed to be in a lower tax bracket when you retire? I don’t want to mince words. If you are in a lower tax bracket, it only means one of two things happened: you didn’t save enough money or the money you saved hasn’t performed well—and you don’t want to be in either scenario.

Doesn’t it make sense to have a financial plan designed to be successful so that at retirement you are in a higher tax bracket as a result of your successful financial planning and investing? Of course, it does. Putting a financial plan together, assuming that you’ll be in a lower tax bracket, is another way of you conceding that you are going to be a financial underachiever. Why would you want to be that person? How about you put a plan together based on you being successful and as a result being in a higher tax bracket? That’s a plan based on success. That’s what I want. How about you?

The goal should be how to deal with taxes that come with your successful investing, as you will see. The bottom line is this: if you are banking on taxes being lower when you retire, then you are in for a wake-up call. So, with that in mind, let’s go back to that perfect retirement that I had you think of earlier. Remember? House paid off, kids grown, big old qualified retirement accounts?

Our income tax is going to hurt. Because our house is paid off and our kids are grown, the two biggest tax deductions we enjoyed our entire lives are gone when we need them most. And, what did you get for this “perfect retirement”? Your money completely tied up and illiquid for 20 or 30 years. Come on! That is brutal. I mean, how did we get duped into this?

Work with Dean Vagnozzi

As a successful name in the world of Financial Planning, Dean Vagnozzi helps middle-class investors make great profits in an industry widely dominated by big sharks. Dean empowers new entrants to make good investments by offering relatively safe investments that deliver outstanding returns with fixed future payouts that have nothing to do with wall street.

Dean Vagnozzi has identified 5 proven asset classes that are not new. They have been around for decades, but have traditionally been utilized as investments by the ultra-rich due to the fact that they are very cash-intensive to get involved in. As with so many things, there’s strength in numbers and the same is true when it comes to investing. Dean Vagnozzi works with one of the nations largest law firms to put a series of “funds” together that comply with state and federal securities laws that allow the middle class to pool their investment dollars with other like-minded investors to invest like the big boys with a fraction of the initial capital that is needed to invest in these asset classes by themselves.

When collaborating with customers, Vagnozzi allows them to see under the hood of his operation and the investments to make them feel comfortable sharing every detail of their finances with him so that he can dive deep into their pain points and understand their complete financial picture in order to come up with the best course of action. Get in touch with Dean Vagnozzi and his team of talented advisors by visiting www.abetterfinancialplan.com.

![Calgary’s Hottest Neighborhoods for Luxury Homebuyers [2024]](https://thewashingtonote.com/wp-content/uploads/2024/04/Calgary-324x160.png)