The financial service industry deals with monetary exchange such as currency change, investments, deposits, and loans. Financial institutions, including banks, credit unions, mortgage lenders, insurance companies, and brokerage firms, engage in various business operations within the financial sector. Thus, financial organizations play an essential role in the economy.

Nearly everyone in a structured economy needs a financial institution’s services at some point. They offer a diversity of investment, deposit, and lending services to individuals and businesses. Some financial firms focus only on specific customers with more tailored offerings. Years of global disruptions have left the modern financial services industry with numerous challenges, an uncertain future, and fears of recession.

Financial activities are increasingly digitized in response to these trends in the financial services industry. Financial institutions and startups are sharpening their technology and expanding remote services while maintaining a tight grip on security and compliance. Investing in technology is a long-term strategy to secure the future of their businesses.

4 Trends in the Financial Services Industry to Watch in 2024

The financial services industry is focused on intensifying revenue streams due to a tightening economic environment. Here are 4 of the most prevalent trends in the financial industry that is shaping the insurance, wealth, and banking firms for 2024 and beyond:

1. An Evolving Competitive Landscape

The ways and patterns in which consumers access financial services are rapidly changing. The emergence of newer digital-first providers and Big Tech firms like Amazon and Google has caused disruptions in the market and influenced customer behaviors. Hence, organizations must continuously focus on finding innovative ways to keep up with trends.

2. Consumers Demand Better Experiences

Customers demand more satisfying digital experiences. To address these demands, organizations must prioritize offering mobile-friendly, easy-to-use, digital self-service, and convenient options that fit seamlessly into their daily lifestyle. More than 70% of customers prefer digital experiences to access their financial lives anytime and anywhere.

3. Integrating Systems and Streamlining Manual Workflows

Financial services industries are remodeling their operations by automating crucial processes, incorporating systems, and uploading their data ecosystem to the cloud. These moves are designed to increase productivity and reduce costs and vendor footprint while they grow their business with less staffing and fewer resources.

4. Security and Fraud Mitigation

As virtual jobs and digital transactions have increased over the past few years, cybersecurity, leaked records, fraud risks, and data breaches have also increased. Hence, financial services firms must make security a priority in 2024 and beyond. They are encouraged to implement the best practices in cyber incident reporting and information security.

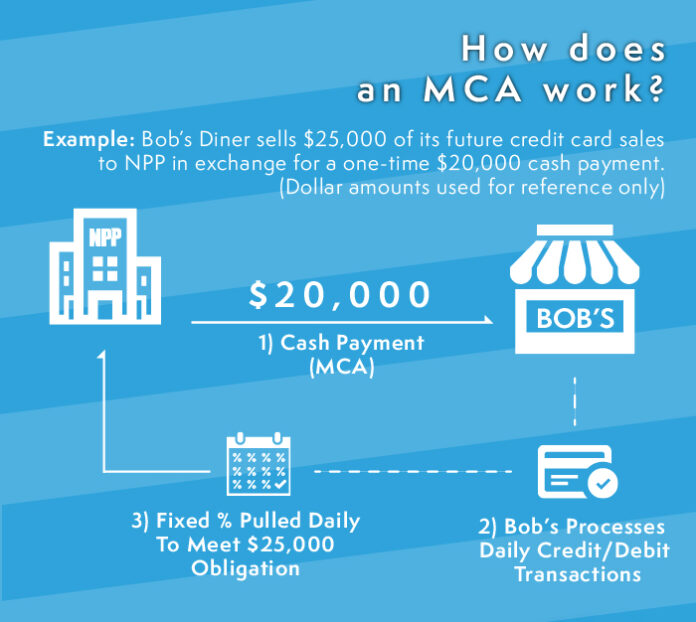

Obtaining loans from traditional banks is one way to fund your business, but there are other various offers on the market for business financing – an alternative lending scheme. The Merchant Cash Advance (MCA) platform provides a great way to obtain funding for your business, excluding the bothers and fees associated with traditional bank loans. A merchant cash advance is a business funding option you can repay with a percentage of your sales.

What is A Merchant Cash Advance Platform?

A Merchant Cash Advance (MCA) platform is best for business owners who encounter difficulty securing business loans from banks and other financial firms. New startup businesses with high credit card sales volume need funding quickly, or those without a steady cash flow and cannot guarantee regular payments can also benefit from the MCA platform. With a Merchant cash advance, business owners receive upfront funds as a lump sum from a merchant cash advance provider.

The funding provider gets repaid automatically by taking a portion of future credit card sales, usually daily (sometimes weekly) on business days and based on past debit and credit card sales. Some MCA providers base their payment on how much your business receives in sales. On days when your sales are low, you pay less – this helps with cash flow. Business owners usually get approval for funding in a day or two, with little paperwork, making it an ideal funding option when your business needs money fast.

Other benefits of an MCA platform include the following:

- It’s not a loan and requires no fixed monthly payments.

- Unlike banks’ lending conditions, no upfront costs and charges are required.

- Repayment conditions are flexible. There are no heavy penalties for missing your repayment due dates.

- There’s no need to stress over credit scores and other financial documentation.

- The application process is easy and quick. You get fast access to cash after approval.

- The lending firm will not specify how you spend the advance funding you receive, but whatever you use it for should be good for the business.

- It works alongside other funding options.

What is MCA Software? How Can It Help a Business?

Merchant Cash Advance Software is a financial software solution explicitly designed for lenders that provide cash advances to small and medium-sized businesses. The software helps automate every step in the lending process, from application through submission, loan allocation, and repayment. It helps to streamline your operation and incorporate everything you need on a single platform.

With the help of Merchant Cash Advance software, MCA business owners (lenders and providers) can keep accurate client information and ensure customers are monitored on a timely basis to keep track of their loan pipelines. MCA software helps to keep the business running smoothly. It is a central archive for contact information, papers, underwriting information, and other related documents.

An MCA software has some essential features that are helpful for all business types and sizes. Features include customer profile management, credit card analytics, sales performance tracking, API and customization, automated decision-making, risk assessment, and loan management. MCA software can help a business grow in many ways, and some of the benefits it offers include:

- Faster loan processing times: MCA software with AI integration can reduce the time spent and resources required to approve and fund merchant cash advances, increasing overall efficiency. Small businesses need fast funding to take on new opportunities, so waiting weeks for funds approval is just out of the question. Also, lenders can use the merchant cash advance software to reduce manual errors for a more efficient lending process.

- Improves customer experience: It offers a more streamlined application process, and customers can apply for funds online. The software automatically examines their bank statements, credit scores, and other necessary information. This makes the process more convenient and can lead to higher customer satisfaction rates. With the software, you can also keep track of all your customer satisfaction metrics, so your focus area will be on providing prompt solutions and creative ways to increase customer retention and happiness.

Source: getzlerhenrich.com - Enhanced analytics and reporting: Analytics are critical for MCA businesses because they help lenders better understand their customers’ behavior and identify trends to make informed lending decisions faster. With the current financial services trends, lenders must stay competitive to drive their business to achieve its primary goals. The software place you in a better position to respond to market changes and take advantage of market trends for growth opportunities.

- Risk assessment and Credit scoring: Merchant cash advance business owners face significant risks when making lending decisions, but the chances of default can be reduced with the help of the right MCA software. It integrates credit scores and other financial data statements to assess applicants’ credibility accurately. By doing this, the rate of profitability improves.

Conclusion

In recent years, the financial sector services, including banks, have faced various challenges. Due to this, banks must focus on ways to secure the future of their institutions strategically without jeopardizing their standards. Banks and lending firms must know that employing the right technology can make all the difference in your business.

With so many aspects of the banking industry changing, all businesses connected to the banking industry must be informed and step-up. Utilizing the MCA software can position banks and lenders to deliver better digital experiences, increase customer satisfaction, improve data security, and increase profitability.

![Calgary’s Hottest Neighborhoods for Luxury Homebuyers [2024]](https://thewashingtonote.com/wp-content/uploads/2024/04/Calgary-324x160.png)