If you are new to investing in real estate, you may wonder whether tax lien certificates are a good idea. While there are many benefits to investing in tax lien certificates, there are also some risks that you should be aware of. Moreover, the most successful tax lien investors go beyond the basics.

What Is Tax Lien Investing?

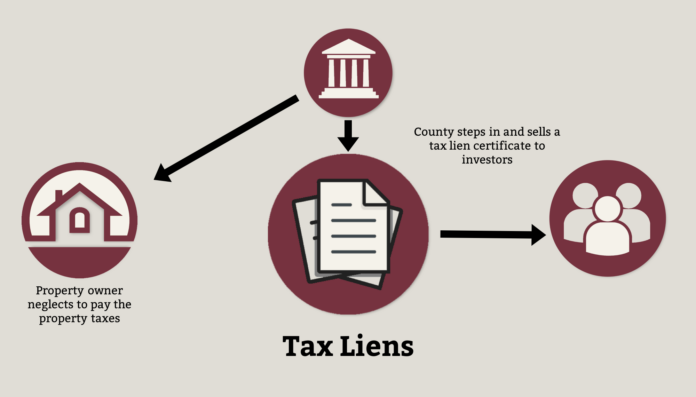

Tax liens are issued by over 2000 county governments when property owners fail to pay their property taxes. The certificates provide the county with a way to recoup the money owed plus penalties and interest. They also provide a mechanism for investors to earn high interest, or the property itself if the property owner fails to pay.

When the property owner pays their back taxes within the grace period, the governing body will buy back the certificate — plus interest — from the certificate holder. If the property holder does not pay their back taxes, the lienholder may begin a process to foreclose on the property, thus acquiring that property free and clear, with no mortgage.

Tax liens certificates are available for single-family homes, commercial/industrial buildings, land, etc. Only 21 states offer tax lien certificates to retail (non-institutional) investors. Each county has different rules regarding tax liens, including the interest rates charged. As a tax lien investor, it’s best to focus on single-family homes, and ones specifically in the best neighborhoods with the best school districts, to minimize the risks to your capital.

The Benefits of Tax Lien Investing for Beginners

Investing in tax lien certificates can be a good way to diversify your portfolio. However, certain risks are associated with this investment, so you will want to do thorough research.

Investing in tax liens requires that you learn about the property and the real estate market in general. It means you must understand the auction process, tax lien laws and regulations, the property’s value, how foreclosure works, etc. Not sure what is foreclosure? Dive in-depth into this legal process in RealVantage’s article here.

Tax lien investing is not a short-term venture. You will typically need to hold on to your assets for one to three years.

Here are the major benefits of a successful tax lien investment from a beginner’s point of view:

- It is an easy business to understand

- There is no need for a lot of capital investment

- One can learn how to make money off of tax liens almost immediately

Where and How Do You Learn to Invest in Tax Liens?

Buying tax lien certificates may seem like a lucrative investment, but you need to be prepared to put in the time and effort to do your research and invest wisely. In addition, investing in tax liens requires some knowledge of the fundamental principles of real estate investing, including rehabbing, renting, and flipping.

Investing in tax liens is a growing niche among many real estate investors. Tax liens offer a predictable return on investment and the potential to own property for a fraction of its value. But before you invest, you need to know more about the process. So, start with a tax lien online course to get your bearings and continue building your education in tax lien certificates, real estate investing, etc. You can become successful if you stay on your learning path.

Tax Lien Risks Beginner Investors Should Know

Investing in tax liens is a good way to earn money, but there are many risks for beginners. Therefore, before investing, it is important to learn as much as possible about the real estate market and the comparable properties in the area.

One risk is that many property owners with a tax lien will redeem the tax lien certificate (paying off the debt) before foreclosure can commence, so don’t assume you’ll get the property.

Tax lien certificates are typically sold at auction, and you’ll often be going up against savvy institutional investors. So be prepared: not everything will end up being a great – or even good – deal. Thankfully though you can also buy certificates through “assignment purchases” and avoid the auction process.

Another risk to consider is the state of the property. Foreclosure can be time-consuming, and the property’s value can drop during foreclosure.

Some properties lose all of their value. From termite-infestation or land nobody can build on to local environmental problems or an extremely complicated succession process, you face the danger of acquiring a claim to one of these worthless properties. In the event of a foreclosure, you will own a property that cannot be sold to recuperate your investment.

Other risks include the following:

- The property is in an undesirable neighborhood. It’s wise to conduct thorough research before investing in tax liens in controversial areas.

- Environmental issues. Good property with high value is rarely found in an area with an environmental issue, but if you find one, steer clear of it.

- Local government can punish the property owner if the lawn becomes overgrown, paint peels, trash builds up, or any other issues occur. Since the owners must maintain the properties, the local government can impose fines if the property isn’t maintained. The penalties and related expenses can add up.

For these reasons and many more, you must thoroughly research each property and its neighborhood / market before investing.

Conclusion

Buying tax liens can be profitable if you have the time and knowledge. However, this type of investment can also be risky. Therefore, before you invest, you must research and understand the risks and the rules for the area you buy in.

The first thing you need to do is get in touch with people who can help you. Discuss with veteran tax lien investors, seasoned tax professionals, real estate investors, and/or real estate attorneys.

After that, you can begin to research properties in the areas you want to invest in (and you have over 2000 counties to choose from). When it comes to tax lien investing, due diligence is vital. You can acquire tax lien certificates through auctions or assignment purchases.

![Calgary’s Hottest Neighborhoods for Luxury Homebuyers [2024]](https://thewashingtonote.com/wp-content/uploads/2024/04/Calgary-324x160.png)